Director James Gorman Acquires 20,000 Shares of The Walt Disney Co (DIS)

On May 8, 2024, James Gorman, Director at The Walt Disney Co (NYSE:DIS), purchased 20,000 shares of the company, as reported in the SEC Filing. This transaction increased the insider's total holdings in the company to 20,000 shares.

The Walt Disney Co (NYSE:DIS) operates as a diversified international family entertainment and media enterprise. It is well-known for its film productions, theme parks, and television networks.

The shares were bought at a price of $106.03 each, valuing the transaction at approximately $2,120,600. Following this purchase, the market cap of The Walt Disney Co stands at $192.88 billion.

The company's current price-earnings ratio is 115.00, significantly above both the industry median of 19.235 and the historical median for the company. This valuation metric suggests a premium compared to industry standards.

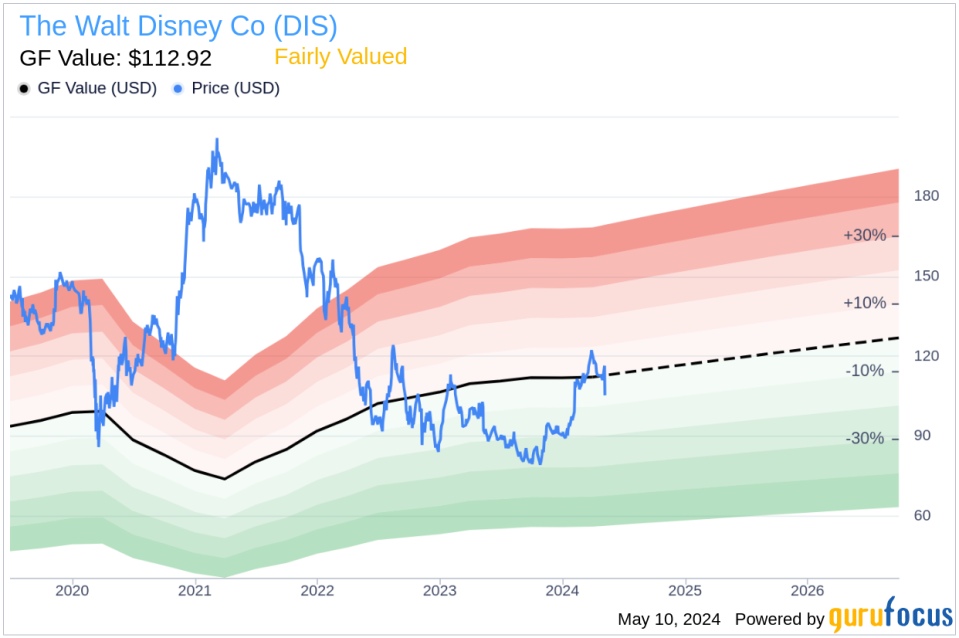

According to the GF Value, the intrinsic value of The Walt Disney Co's stock is estimated at $112.92 per share, making the stock Fairly Valued with a price-to-GF-Value ratio of 0.94.

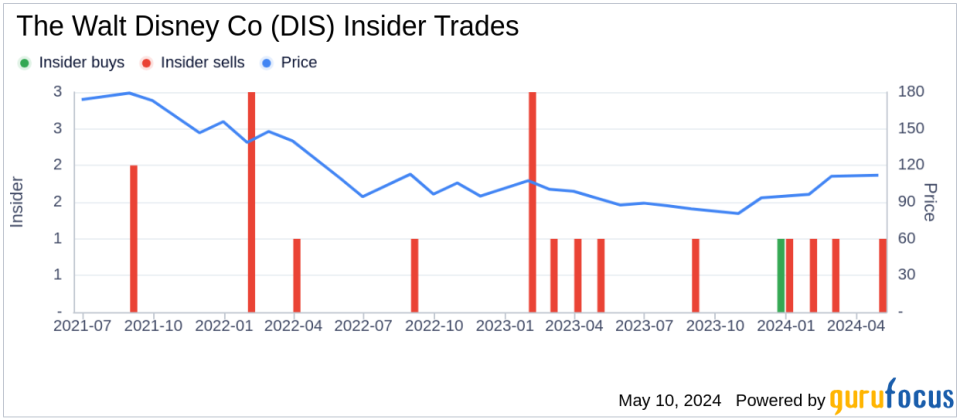

Over the past year, there have been 2 insider buys and 6 insider sells at The Walt Disney Co. The insider's recent purchase aligns with a broader context of insider trading activities at the company.

Insider buying can often provide insights into a company's future prospects or signal the insider's confidence in the company's performance. In the case of The Walt Disney Co, the insider's decision to increase their stake might be seen as a positive indicator by some investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.