Three Growth Companies In India With High Insider Ownership And Up To 24% Revenue Growth

In the last year, India's market has shown remarkable growth, rising by 41%, despite a recent 1.5% drop over the past week. In this environment of robust earnings projections, companies with high insider ownership and significant revenue growth stand out as particularly noteworthy investments.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 29.0% |

Pitti Engineering (BSE:513519) | 33.6% | 36.5% |

Triveni Turbine (BSE:533655) | 28.6% | 21.1% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 25% | 26.7% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 25.8% |

Paisalo Digital (BSE:532900) | 16.3% | 27.8% |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | 41.7% |

Kirloskar Pneumatic (BSE:505283) | 30.7% | 27.7% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 26.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

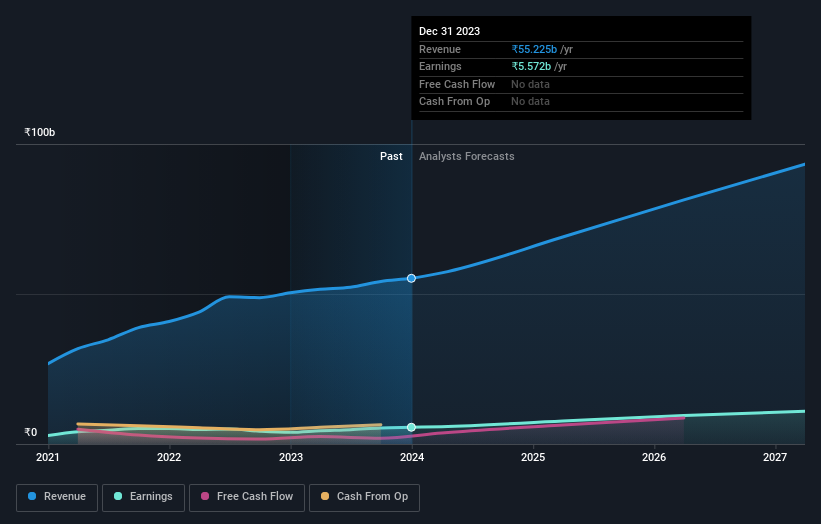

Astral

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astral Limited operates in the manufacturing and marketing of pipes, water tanks, adhesives, and sealants both in India and internationally, with a market capitalization of approximately ₹556.61 billion.

Operations: The company generates revenue primarily through two segments: plumbing, which contributes ₹40.40 billion, and paints and adhesives, accounting for ₹14.82 billion.

Insider Ownership: 39.4%

Revenue Growth Forecast: 16.6% p.a.

Astral, a growth-oriented company in India, showcases strong future potential with its high Return on Equity forecast at 21.8% and earnings expected to grow by 22.45% annually. Despite revenue growth projections of 16.6% per year not reaching the 20% threshold, it still outpaces the broader Indian market's 9.8%. Insider transactions have been minimal recently, indicating stable but not aggressive insider confidence in the stock's trajectory.

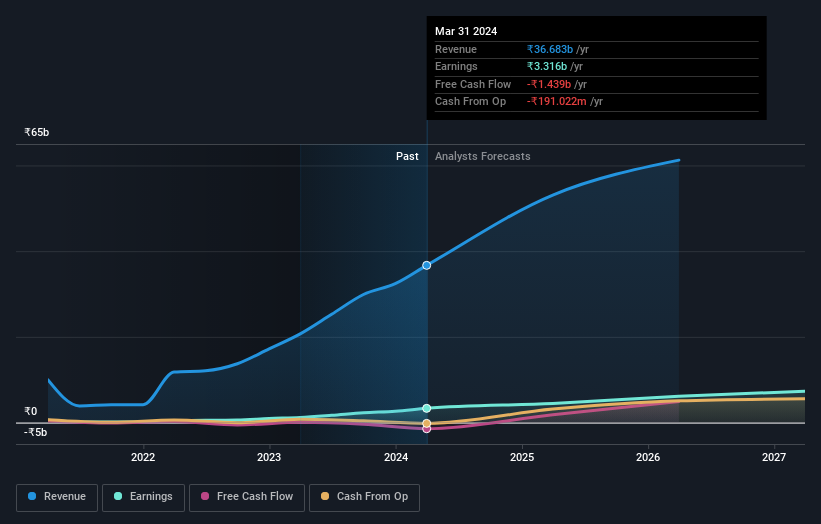

Jupiter Wagons

Simply Wall St Growth Rating: ★★★★★★

Overview: Jupiter Wagons Limited is a company based in India that manufactures and sells mobility solutions both domestically and internationally, with a market capitalization of approximately ₹17.33 billion.

Operations: The firm operates in the production and international sale of mobility solutions, boasting a market capitalization of roughly ₹17.33 billion.

Insider Ownership: 11.1%

Revenue Growth Forecast: 24.4% p.a.

Jupiter Wagons Limited has demonstrated robust growth, with earnings increasing by 174.5% over the past year and revenue forecasted to grow at 24.4% annually, outpacing the Indian market's average. Despite shareholder dilution last year, the company maintains a strong forecast Return on Equity of 26%. Recently, Jupiter secured a significant contract worth INR 9.57 billion from the Ministry of Railways for BOSM wagons, underscoring its expanding market presence and operational capabilities.

Take a closer look at Jupiter Wagons' potential here in our earnings growth report.

Our valuation report here indicates Jupiter Wagons may be overvalued.

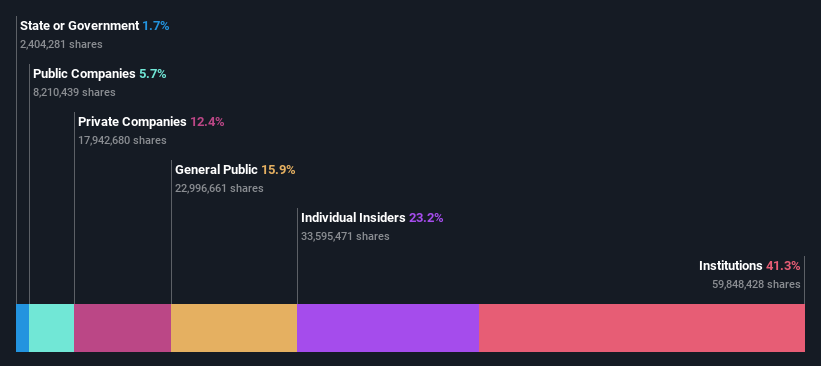

Kirloskar Oil Engines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kirloskar Oil Engines Limited is a company based in India that specializes in manufacturing and distributing diesel engines, agricultural pump sets, electric pump sets, power tillers, generating sets, and spares both domestically and internationally, with a market capitalization of approximately ₹152.84 billion.

Operations: The company's revenue is segmented into business-to-business (B2B) sales at ₹40.07 billion, business-to-consumer (B2C) sales at ₹11.00 billion, and financial services generating ₹5.15 billion.

Insider Ownership: 23.2%

Revenue Growth Forecast: 11.4% p.a.

Kirloskar Oil Engines has shown consistent earnings growth of 15.7% annually over the past five years, with future earnings expected to increase by 24.84% yearly. Although its revenue growth forecast of 11.4% per year is modest compared to some peers, it still outstrips the broader Indian market's average of 9.8%. The company recently bolstered its leadership by appointing Sachin Kejriwal as CFO, enhancing its financial strategy capabilities amidst these promising financial trends.

Make It Happen

Access the full spectrum of 87 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ASTRAL NSEI:JWL and NSEI:KIRLOSENG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com