Top 3 Japanese Growth Stocks With High Insider Ownership In May 2024

As of May 2024, the Japanese market has shown resilience with the Nikkei 225 and TOPIX indices posting gains amidst global economic fluctuations and currency interventions. This backdrop provides a fertile environment for examining growth companies in Japan, particularly those with high insider ownership which can signal strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.5% | 27.2% |

Medley (TSE:4480) | 34.1% | 23.6% |

Hottolink (TSE:3680) | 27% | 54.3% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

Micronics Japan (TSE:6871) | 15.3% | 37.4% |

Money Forward (TSE:3994) | 21.4% | 63.4% |

ExaWizards (TSE:4259) | 24.8% | 84.3% |

en-japan (TSE:4849) | 14.7% | 26.6% |

freee K.K (TSE:4478) | 24% | 79.8% |

Soracom (TSE:147A) | 17.2% | 68.9% |

Here's a peek at a few of the choices from the screener.

Money Forward

Simply Wall St Growth Rating: ★★★★★★

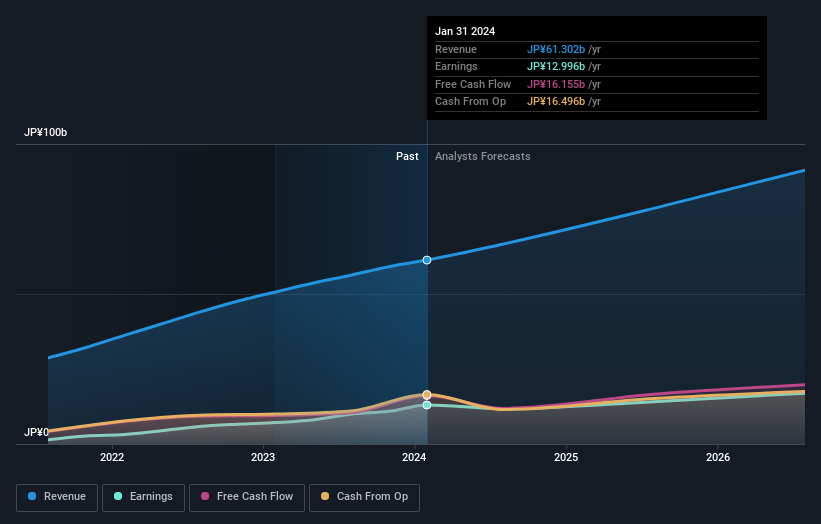

Overview: Money Forward, Inc. offers financial services to both individuals and businesses, with a market capitalization of approximately ¥333.12 billion.

Operations: The firm generates revenue by offering financial services tailored to both personal and corporate needs.

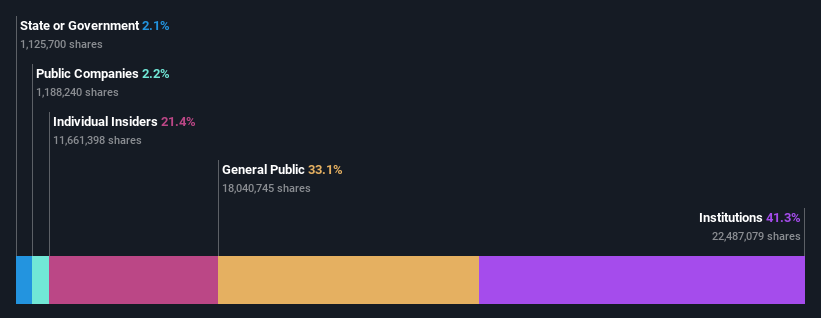

Insider Ownership: 21.4%

Earnings Growth Forecast: 63.4% p.a.

Money Forward, a growth company in Japan with high insider ownership, is poised for significant advancements. The firm is trading at 35.5% below its estimated fair value and expects to become profitable within three years, outpacing average market growth. Its revenue is projected to increase by 21.8% annually, significantly faster than the Japanese market's 4.4%. However, it faces challenges such as a highly volatile share price and recent considerations for issuing new shares as restricted stock compensation.

Visional

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc. operates in Japan, offering human resources platform solutions through its subsidiaries, with a market capitalization of approximately ¥309.88 billion.

Operations: The firm generates its revenues primarily through human resources platform solutions in Japan.

Insider Ownership: 40%

Earnings Growth Forecast: 14.8% p.a.

Visional, a Japanese growth company with high insider ownership, is trading at a substantial 52.6% below its estimated fair value. Analyst consensus forecasts a robust 24.4% return on equity in three years and anticipates earnings to grow by 14.83% annually, outperforming the Japanese market average of 9.5%. Revenue growth projections stand at 13.8% per year, also above the market's 4.4%. However, the stock has experienced high volatility recently and earnings growth is not considered significantly high.

Click here to discover the nuances of Visional with our detailed analytical future growth report.

Our valuation report here indicates Visional may be undervalued.

CyberAgent

Simply Wall St Growth Rating: ★★★★☆☆

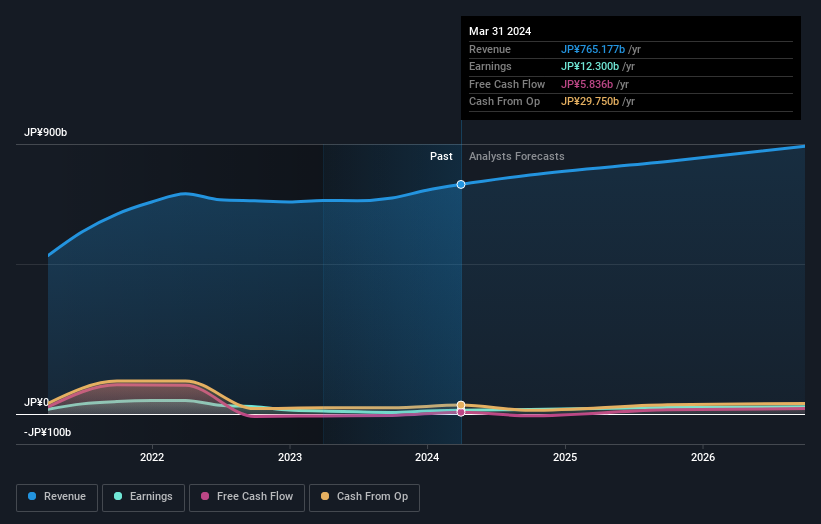

Overview: CyberAgent, Inc., primarily operating in Japan, is involved in media, internet advertising, gaming, and investment development with a market capitalization of approximately ¥496.96 billion.

Operations: The company's revenue is generated through three main segments: internet advertising at ¥42.22 billion, gaming at ¥18.83 billion, and media at ¥15.91 billion.

Insider Ownership: 19.4%

Earnings Growth Forecast: 21.1% p.a.

CyberAgent, a Japanese growth company with high insider ownership, is currently trading at 30.3% below its estimated fair value. Despite some large one-off items affecting its financial results, the company has seen earnings grow by 23.5% over the past year and forecasts suggest an annual earnings increase of 21.1%, significantly outpacing the Japanese market's average of 9.5%. However, its return on equity is expected to be low at 13.6% in three years' time compared to sector benchmarks.

Unlock comprehensive insights into our analysis of CyberAgent stock in this growth report.

Our valuation report here indicates CyberAgent may be overvalued.

Next Steps

Click here to access our complete index of 106 Fast Growing Japanese Companies With High Insider Ownership.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:3994 TSE:4194 and TSE:4751.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com