Select Harvests (ASX:SHV) investors are sitting on a loss of 43% if they invested five years ago

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Select Harvests Limited (ASX:SHV) shareholders for doubting their decision to hold, with the stock down 47% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 24%. More recently, the share price has dropped a further 20% in a month.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Select Harvests

Select Harvests isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over half a decade Select Harvests reduced its trailing twelve month revenue by 6.4% for each year. While far from catastrophic that is not good. The share price decline at a rate of 8% per year is disappointing. But it doesn't surprise given the falling revenue. Without profits, its hard to see how shareholders win if the revenue keeps falling.

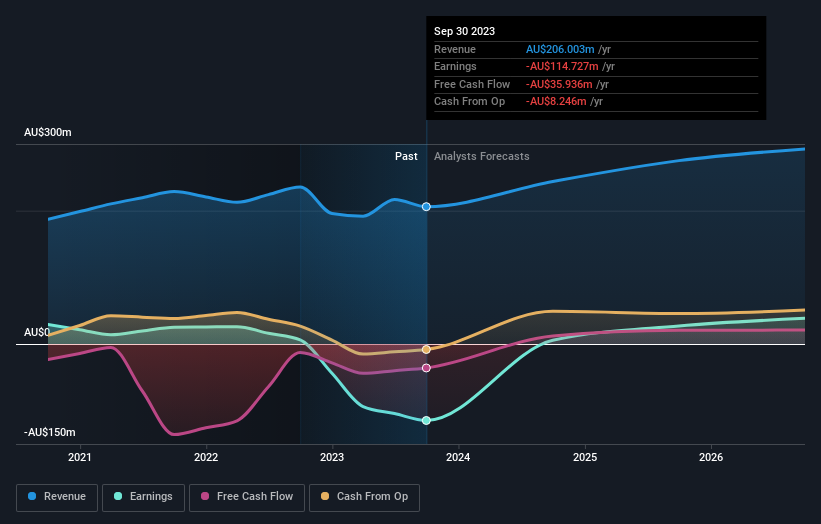

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Select Harvests in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Select Harvests' total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Select Harvests shareholders, and that cash payout explains why its total shareholder loss of 43%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in Select Harvests had a tough year, with a total loss of 24%, against a market gain of about 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Select Harvests better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Select Harvests you should be aware of.

Select Harvests is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.