Better Dividend Stock: AbbVie or Johnson & Johnson?

There are many dividend stocks on the market, but few are as prominent as AbbVie (NYSE: ABBV) and Johnson & Johnson (NYSE: JNJ). These companies have raised their payouts for over 50 consecutive years, making them members of the small club of Dividend Kings. Though AbbVie and Johnson & Johnson are both great for passive income, these corporations have important differences. Investors on a budget may want to pick just one of these two options, but which one looks like the better dividend stock?

The case for AbbVie

At first glance, AbbVie doesn't seem like a particularly attractive stock right now. The company's revenue is dropping. Last year, it lost patent protection for what was by far its biggest cash cow -- and one of the most lucrative drugs in the industry's history -- immunology medicine Humira. Even so, AbbVie expects to return to top-line growth in 2025. Its roster of newer medicines is picking up the slack.

That's particularly the case with Skyrizi and Rinvoq, which round out the drugmaker's immunology lineup. Together, these medicines will generate $27 billion in revenue by 2027, roughly $6 billion more than Humira's peak sales. Their sales will continue growing long after. AbbVie's lineup boasts several other blockbusters, and the company's innovative wheel is still spinning.

With 90 ongoing programs, AbbVie should be able to add brand-new products to its portfolio. Last year, the company earned approval for Epkinly, a new cancer medicine that could reach peak sales of $3 billion in the U.S. alone, according to some estimates. So, despite its revenue currently declining, AbbVie will be just fine. The pharmaceutical giant should be able to sustain its dividend program.

AbbVie has raised its payouts for 52 consecutive years, taking into account its time under medical device giant Abbott Laboratories. In the 11 years since it split from its former parent company, AbbVie's dividend has grown by 287.5%. AbbVie offers a yield of 3.73%, much higher than the S&P 500's average of 1.35%. Its cash payout ratio is reasonable at just under 48%. Investors should expect annual dividend raises with AbbVie for many more years.

The case for Johnson & Johnson

Johnson & Johnson has a vast portfolio of medicines and medical devices. Within its biopharma division, the company boasts more than 10 blockbusters. It also has an incredibly deep pipeline that features 95 ongoing programs.

Last year, Johnson & Johnson got rid of its consumer health division, which sold over-the-counter healthcare products. Though this means less diversification for the company, this unit was dragging its revenue growth down. So, Johnson & Johnson should improve on that front, especially as it focuses more energy and resources on developing innovative medicines, which it has been doing for a very long time.

Johnson & Johnson's medical device segment also looks promising. Last year, it acquired Abiomed, a company that develops devices for heart-related problems. The transaction cost Johnson & Johnson about $16.6 billion.

The healthcare giant's medtech business is growing faster on the top line. It should also give it the flexibility to get around regulatory issues, notably the Inflation Reduction Act, passed in the U.S. in 2022, that allows Medicare to negotiate the prices of certain drugs it spends the most on. Some of Johnson & Johnson's medicines have already been targeted, but the company should successfully navigate around this issue, partly thanks to its medtech division.

What about Johnson & Johnson's dividend program? The company is also currently on its 61st consecutive year of payout hikes. In the past 11 years, it has raised its dividends by 103.3%. Its yield currently tops 3.35%, while its cash payout is a little high, though still manageable, at 66.21%. Johnson & Johnson's impeccable dividend track record and solid underlying operations make it unlikely that it will suspend its dividend program anytime soon, or even reduce its payments.

The verdict

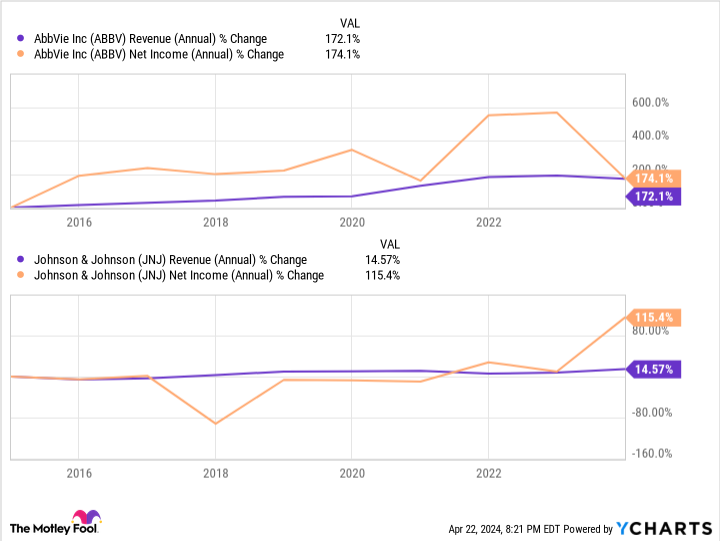

Johnson & Johnson generates more revenue and net income. However, AbbVie has grown faster over the past decade in these categories.

Furthermore, AbbVie's payouts have increased much faster, its yield is higher, and its cash payout ratio is lower. Lastly, though AbbVie is facing a patent cliff, all drugmakers eventually do. Johnson & Johnson has encountered some less common issues, including legal problems related to its talc powder, which allegedly caused patients' cancer. With all that said, AbbVie is currently the better option for dividend investors, although Johnson & Johnson is also a good pick.

Should you invest $1,000 in AbbVie right now?

Before you buy stock in AbbVie, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AbbVie wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Prosper Junior Bakiny has positions in Johnson & Johnson. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

Better Dividend Stock: AbbVie or Johnson & Johnson? was originally published by The Motley Fool