2 Incredible Stocks That Billionaires Are Buying Hand Over Fist

It can be very profitable to track what billionaire investors are buying. After all, these investors typically became billionaires by amassing a long track record of savvy investing.

Which stocks are billionaire investors buying right now? Two in particular stand out.

Ray Dalio is getting defensive with this dividend stock

Ray Dalio's investment firm, Bridgewater Associates, manages more than $100 billion in assets. It runs one of the largest hedge funds in the world, acquiring that scale through an impressive long-term track record of success.

Which stocks are Dalio's firm buying right now? One of its favorites is Altria Group (NYSE: MO). It has owned shares since the third quarter of 2021, but last quarter, it decided to up its bet by more than 30%, with a total stake exceeding 76 million shares.

What's so attractive about Altria stock today? The company is commonly viewed as a defensive stock. That is, when markets fall, stocks like Altria typically weather the storm with less pain. This is true of most tobacco stocks, which sell products to consumers who keep buying regardless of economic conditions.

Might Bridgewater be worried about an economic recession or a market downturn? Maybe, but it might simply be attracted to Altria's bargain valuation. Shares currently deliver a free cash flow yield of 12%, one of its highest levels in decades. That yield is made possible by ample free cash flow levels but also a declining share price. The downside to defensive stocks is that they often underperform during strong bull markets.

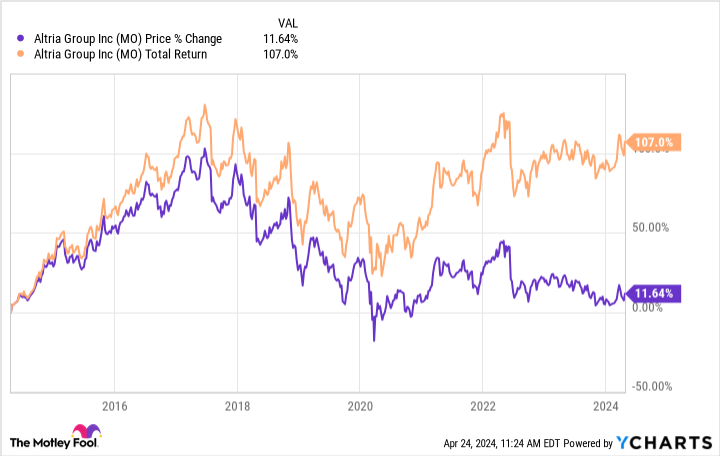

Over the last decade, for instance, Altria's stock price has grown by just 11.6%. Ample free cash flow, however, has allowed it to pay a reliable dividend, with a current yield of around 9.2%. When including the dividend, shares have delivered a 107% total return over 10 years.

With a dirt-cheap valuation and a hefty but affordable dividend yield, don't be surprised to see Dalio and Bridgewater continue to build on their Altria investment.

Follow Warren Buffett into this $19 billion investment

Warren Buffett and his holding company, Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B), run one of the world's most tracked portfolios. Right now, Berkshire is buying shares of Chevron (NYSE: CVX) like there's no tomorrow. The firm has held Chevron stock since the fourth quarter of 2020, but last quarter, it upped its position by nearly 16 million shares, bringing its total position to 126 million shares worth around $19 billion.

Chevron is now one of Berkshire's largest positions. Why might Buffett and Berkshire be so bullish about the company? Like Altria, Chevron shares are historically cheap, according to some valuation metrics. Its free cash flow yield, for example, is around 6.5% -- more than double its five-year average. Ample free cash flow fuels a 3.8% dividend, as well as aggressive share repurchases. Last year, for example, the company authorized a $75 billion stock buyback program, replacing a previous $25 billion repurchase program. In combination, these two programs represent nearly one-third of Chevron's total market cap.

To be bullish on Chevron, one should be bullish on energy prices. However, the direction of oil and gas prices is difficult to predict. Fortunately, Chevron has proven it can capitalize in both favorable and unfavorable environments. Shares, for example, have delivered a total return of 99.6% over the past five years, even as oil prices fell by around 20%. Buffett and Berkshire likely love this performance, which delivered a strong return despite difficult conditions.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Chevron. The Motley Fool has a disclosure policy.

2 Incredible Stocks That Billionaires Are Buying Hand Over Fist was originally published by The Motley Fool